Additional Pathway to CPA Licensure Is Now in Effect

–

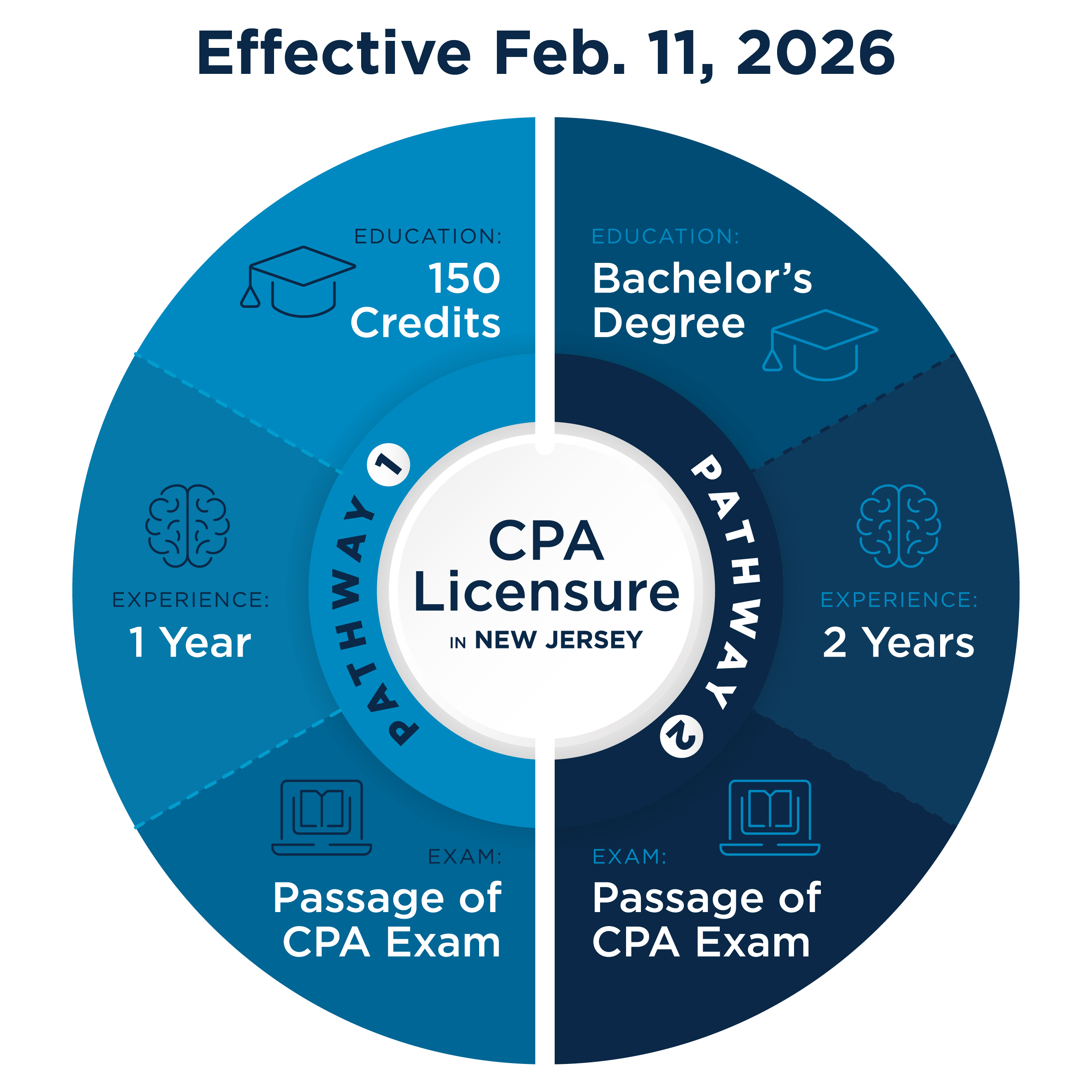

February 11, 2026

Legislation Advances the Profession and Helps CPA State Mobility

A bill intended to increase access to the accounting profession by offering an additional option for CPA licensure in New Jersey went into effect on Feb. 11. The New Jersey Society of Certified Public Accountants (NJCPA) worked with primary bill sponsors Assemblyman Sterley S. Stanley (D-18) and Senator Anthony Bucco (R-25) on A5598/S4493, which was signed by former Governor Murphy on Jan. 12.

The bill makes it possible for those considering CPA licensure to qualify by earning a bachelor’s degree, completing two years of work experience and passing the CPA Exam. Previously, candidates had only one option, which included earning at least 150 credits (typically 30 credits more than a bachelor’s degree or equivalent to a master’s degree), having one year of work experience in accounting and passing the CPA Exam.

New licensure pathway option: In addition to the existing 150-hour option, candidates will be able to pursue a CPA license by earning a bachelor’s degree, completing two years of experience and passing the CPA Exam.

New licensure pathway option: In addition to the existing 150-hour option, candidates will be able to pursue a CPA license by earning a bachelor’s degree, completing two years of experience and passing the CPA Exam.

- Individual practice privileges (mobility): CPAs licensed in another state will be able to practice in New Jersey as long as they have a bachelor’s or higher degree, have passed the CPA Exam and have at least one year of experience.

- Reciprocal licensure: The requirements for an out-of-state CPA to obtain a reciprocal license in New Jersey are that the CPA (1) have good moral character; (2) hold a valid license from any state; (3) have a bachelor’s degree or higher with an accounting concentration; (4) have passed the CPA exam; and (5) have been employed as a certified public accountant in the practice of public accountancy for at least one year immediately preceding the application for licensure.

- Safe harbor provision: CPAs licensed in New Jersey prior to the effective date of the bill will automatically retain their license.

“Creating an additional option for licensure enables more candidates to become CPAs and helps advance the accounting profession,” said Aiysha (AJ) Johnson, MA, IOM, CEO and executive director at the NJCPA. “We are truly thankful for the collective support for this legislation from our members, the business community, state legislators and other organizations that endorsed the bill.”

New Jersey joins 24 states that have made similar changes to offer additional pathways to licensure, and others that are in the process of updating their criteria.

The following resources provide additional information about the pathways to obtain CPA licensure in New Jersey: