Breaking Down the Firm into Manageable Parts

by Daniel J. McMahon, CPA, CMAA –

July 10, 2025

What can accounting firms learn from successful football teams? Get to know the four horsemen of firm operations.

Success in team sports isn’t the result of a single player’s talent; it’s the result of an entire roster operating as a cohesive unit. Take football. A winning football team has three distinct units: offense, defense and special teams. Each unit has a unique role and skill set, but they’re all working toward the same goal — defeating the opponent. When every player is crystal clear about their positioning on the field, their responsibilities on every play and the overall game plan, the team performs at its best. And when the home crowd is aligned with the teams overall objective (i.e., winning games) it can add energy, momentum and motivation to give the team an extra edge.

The same principle applies to accounting firms. Like a football team, an accounting firm's success depends on smaller departments within the firm being in sync with the others. When each department is aligned with the firm’s overall mission, vision and values, and when they’re clear about their objectives and executing confidently, the firm runs smoothly and profitably. Just like the home crowd can lift a football team to victory, satisfied clients and trusted partners can amplify a CPA firm’s growth and reputation.

To make that magic happen, you need good governance. It’s about making the organization’s purpose crystal clear to everyone and using proven mechanisms to keep people focused on that purpose. It’s about making sure everyone is using the same playbook and moving in the same direction when it comes to shared values, culture and efficient flow of information.

I’ve found one important trait that separates high-performing accounting firms from average ones: Great firms are composed of professionals who possess diverse but complementary skills and who can drive forward initiatives across the following four key components of a business:

- SALES and marketing

- PEOPLE development and human resources

- Firm ADMINistration

- Delivery of services to CLIENTS

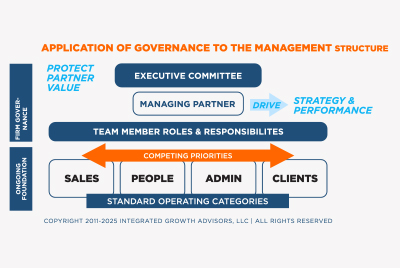

Figure 1

A firm’s strategic plan should be compartmentalized along these four business segments. There is some flexibility when it comes to how the parts are defined, but organizations must have the right internal organizational structure in order to move forward on multiple fronts.

Figure 1 depicts the governance of a firm that’s being driven from the very top of the organization. It starts with the firms executive committee (or board of directors) and the managing partner or CEO and then flows to vice president-level management to oversee sales and marketing (SALES), people development and human resources (PEOPLE), firm administration (ADMIN) and delivery of services to clients (CLIENTS).>

In a CPA firm, the managing partner or CEO is like the head coach of a football team. They set the tone at the top that shapes culture and performance. Auditors assess this tone to identify risks, as weak leadership can lead to shortcuts and inefficiencies. Clear values, expectations and priorities, however, foster a culture in which employees understand their roles, take ownership of their actions and deliver consistent results.

Consider a mid-sized firm that was struggling with inconsistent service, low morale and stagnant growth. By redefining its mission, vision and values — and by ensuring that every department understands its contribution — the firm saw increased engagement, productivity and client satisfaction. Just as a football team’s players rally behind a quarterback with great leadership and communication skills, accounting firm staff are more motivated, engaged and accountable when they have clear, consistent leadership at the top.

As any partner or manager has likely learned over their career, these four categories (sales, people, admin, clients) can challenge you at any given point of any given day. We call these four categories competing priorities, and good governance helps you maintain your sanity when trying to manage them simultaneously.

At this point, I know some of you are rolling your eyes and wondering if all this theoretical talk about governance and accountability has practical applications in the real world. The answer is yes, and it can be measured!

Metrics And Goals: KPIs

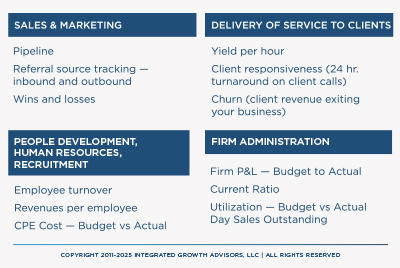

Figure 2

Key performance indicators (KPIs) will help your firm stay on track and achieve its governance goals. Make sure each KPI is specific, measurable and aligned with your firms’ overall goals and strategic objectives. We recommend starting small and adding on as you get more comfortable with this approach.

For instance, Figure 2 contains a short list of measures excerpted from a client’s KPI package.

Firms that take a disciplined approach to driving accountability with the foundation of a sound governance structure tend to be more profitable, more emotionally healthy and better able to retain their people and clients. So, it should be no surprise they tend to have higher valuations than firms that don’t emphasize accountability and governance.

As Vince Lombardi famously said, “Individual commitment to a group effort is what makes a team work, a company work, a society work and a civilization work.”

What is your firm doing to get everyone rowing in the right direction?

| Daniel McMahonDaniel J. McMahon, CPA, CMAA, is the founder and managing partner of Integrated Growth Advisors (IGA), LLC, a value creation and growth advisory firm. More content by Daniel McMahon: |

This article appeared in the Summer 2025 issue of New Jersey CPA magazine. Read the full issue.